How Much Can I Save With an Adjustable-Rate Mortgage?

Read our most important home buying updates for 2024:

Reader question: "I've heard that ARM loans are a good deal right now, because of the rates being so low. But I've also heard they are dangerous and that they basically caused the house crisis. How much money could I save by using an adjustable-rate mortgage loan? And are they worth the risk?"

ARM loans did not cause the housing crisis. Irresponsible lending did. Granted, adjustable mortgages created problems for a lot of homeowners before, during and after the housing bust. But that had more to do with the way they were used than the loans themselves.

As you'll learn during the course of this article, ARM loans are not inherently evil. They have certain pros and cons like any other mortgage product. As a home buyer, the best thing you can do is study those pros and cons, before making a decision.

It's true that you could save money by using an adjustable-rate mortgage loan. But your savings will probably be limited to the first 1 - 5 years of the term. After that, your interest rate might rise to a higher level than a 30-year fixed-rate mortgage. We will discuss all of this in detail below. I'll also show you how much money you might save by with ARM loan, using some realistic numbers.

But first, a bit of background...

How an Adjustable Mortgage Works

A "traditional" mortgage loan has the same interest rate for the full term of the loan, even if the term is for 30 years or more. But the adjustable-rate mortgage (ARM) works differently. As its name implies, the ARM loan has an interest rate that changes during the life of the mortgage. The rate may adjust up or down, depending on the index it is "tied" to.

These days, a lot of adjustable-rate mortgages are tied to the one-year constant-maturity Treasury bill (CMT) or the London Interbank Offered Rate (LIBOR). When these indexes go up, they take the ARM loan interest rates with them.

Most of the ARMs in use today are technically "hybrid" loans. They get this name because they start with a fixed interest rate for a certain period of time, after which they start to adjust periodically. Take, for example, the 5/1 ARM loan. This mortgage product starts off with a fixed rate of interest for the first five years. After that five-year period, the rate will start adjusting every year. That's where the "5/1" label comes from -- five years fixed, followed by adjustments every year thereafter.

How Much Money Can You Save?

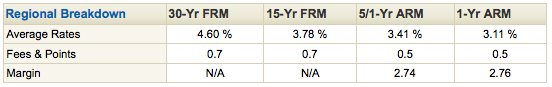

What's the appeal of using an adjustable-rate mortgage loan? Why would somebody choose to ride a rollercoaster of interest rate fluctuations? The answer lies within the initial phase of the loan. During the initial fixed-rate period, a hybrid ARM loan will generally have a lower interest rate than its fixed-rate counterpart. For example, take a look at the mortgage rate snapshot below:

The snapshot above was taken on May 11, 2011. By the time you read this article, the average rates will surely be different than those shown above. But that's not the point. What I want you to focus on is the difference between the 30-year fixed-rate mortgage (FRM) and the 5/1 ARM loan.

You can see that the average rate for the 5/1 ARM is lower than the rate for the 30-year FRM, by more than a percent. This is typical. And it answers the question I posed earlier: Why do people use adjustable-rate mortgages? They do it to secure a lower rate -- at least during the initial phase of the ARM loan. This makes for a smaller mortgage payment each month.

Saving Money With a Lower Interest Rate

So let's play with these numbers and see how much money we could save, by using the 5-year adjustable option instead of the fixed-rate loan. Assuming we could qualify for the average rates listed above, it would break down like this...

- For a $250,000 mortgage loan with an interest rate of 4.6 percent and a 30-year term, my monthly payment would be around $1,281.

- For the same loan amount and term, but with an interest rate of 3.41 percent, my monthly payment would be around $1,110.

So if I used a 5/1 ARM loan to secure the lower interest rate shown in the table above, my monthly payment would be about $171 less than the 30-year fixed-rate mortgage. Remember, the 5/1 adjustable-rate mortgage is a hybrid loan that starts off with a fixed rate for the first five years. During that initial five-year period, I could save more than $10,000 by securing the lower rate that comes with the ARM:

171 x 60 = $10,260 in savings

- 171 = amount of monthly savings resulting from the lower rate

- 60 = the number of months / mortgage payments during the five-year period

- $10,260 = total amount of money I would save by using the ARM with a lower rate

Of course, this is only for the first five years of the adjustable-rate mortgage. After that the interest rate on the ARM loan would begin to adjust every year. So the monthly payment amount would change along with it. You can never predict exactly how the rate will change, but they usually adjust upward over time. So you can certainly save money by using a hybrid-style adjustable mortgage, over its fixed-rate counterpart. But you will also face some uncertainty at the first adjustment point. How much will your monthly payment go up? It's a hard question to answer.

Getting Stuck With an ARM Loan

Some home buyers plan to start out with an adjustable-rate mortgage, and then refinance into a fixed-rate loan later on. This is a reasonable strategy on paper. But several things could happen to prevent you from refinancing:

- You could lose some of your income, and thus your ability to make your payments.

- You could accumulate too much debt in other areas (credit cards, personal loans, etc.).

- Your home could depreciate in value, reducing your equity.

All three of these things could hurt your chances of getting a refinance loan down the road. So you can't roll the dice on an ARM loan by banking on a refi. There's a chance you won't be able to refinance. Could you afford the new payments, once the loan starts adjusting? What if your monthly payments rise significantly? Are you already at the limits of your budget? If so, it's a recipe for default and possible foreclosure.

The same goes for selling the home. Some people use an adjustable-rate mortgage to secure a lower rate, with the intention of selling the home before the first adjustment period. But here again, there's no guarantee you'll be able to sell your home. For instance, if your property value dropped to the point that you were upside down in the loan, you would have a tough time selling the house. You would need your lender's permission as well, if you were unable to pay off the loan through the sale.

Related article: Adjustable-rate versus fixed-rate mortgages

You can save money by using an adjustable-rate mortgage to secure a lower rate. But you need to think about your long-term plans. If you're only going to be in the house for a few years before moving again, the ARM loan might be a smart move. If you're planning to stay in the home for many years, you might be better off with a fixed-rate loan.