Summary: This article explains how to shop for a mortgage loan in 2012. It has been expanded and updated to account for changes in the lending industry over the last few years, such as the general tightening of credit standards.

You hear it all the time. “You need to shop around for a mortgage loan, in order to find the best deal.” But what does this mean exactly? How does one shop for something as complicated as a home loan? And what does it mean to get the best deal? In this tutorial, I’m going to walk you through the various steps of shopping for a mortgage.

This is a long lesson, but please stick with me. You need to understand each of the steps explained below. Many first-time home buyers make costly mistakes when shopping for a mortgage, simply because they didn’t understand the process. This lesson will help you avoid those mistakes.

Mortgage Shopping at a Glance

We are going to get deep into the nitty-gritty of mortgage shopping in this article. Let’s start with an overview of the steps involved. If you feel overwhelmed or confused later on, just refer back to this list of steps. It’s your anchor. It will help you gain perspective again.

How to shop for a mortgage loan:

- Figure out how much you can spend on a monthly payment. You need to do this before contacting banks or lenders.

- Research your mortgage options (fixed vs. adjustable, FHA vs. conventional, etc.). Choose the type of loan that matches your long-term plans.

- Start gathering your financial documents. You’ll need them to get pre-approved, and also when submitting a formal loan application.

- Check your credit scores so you’ll know where you stand. Your score is partly what determines approval versus rejection.

- Get rate quotes / price quotes from at least two lenders (ideally three or four).

- Get pre-approved for a loan with your chosen lender. This will help you shop for a house within your budget and financing range.

- Locate a house that meets your needs and make an offer to buy it.

- Submit a formal application for a mortgage, in the amount you need to buy the house. Include your purchase agreement.

- Review the Good Faith Estimate (GFE) to find out what your closing costs might be. But plan for a larger amount, just in case.

- Agree on the terms of the loan and lock in your interest rate.

You’ll notice that these steps overlap with the house-hunting process. I recommend that you start shopping for a house after getting pre-approved by a mortgage lender, which occurs during step #6. It doesn’t make sense to shop for a home until you know how much of a loan you might qualify for. But let’s not get ahead of ourselves. Here’s what you need to know about each of these steps.

Step 1 – Figure Out How Much You Can Spend

This topic has been covered in depth elsewhere on the Home Buying Institute website. For instance, you can read a complete tutorial on this page. You might be asking the same question that many first-time buyers ask: “What does my budget have to do with shopping for a loan?” It has everything to do with it. You shouldn’t shop for a mortgage loan until you have a specific number in mind. I call this number your financial “comfort zone.” It’s a monthly spending limit that applies to your mortgage payments.

In short, this number tells you how much money you can pay each month for a house payment — without totally sacrificing your quality of life. You need to know this number before you shop for a mortgage or get quotes from lenders. I’ll explain why a bit later, once we’ve covered all eight of the mortgage-shopping steps listed above.

To determine your financial comfort zone, you need to do a bit of math. First, add up your monthly expenses and debts. This will include everything from your car payments to the amount you spend on groceries each month. Everything you spend money on, including whatever amount you contribute to savings and retirement accounts. Subtract this number from your monthly take-home pay (post taxes). A wise home buyer will spend no more than 75% of this remainder on a monthly mortgage payment.

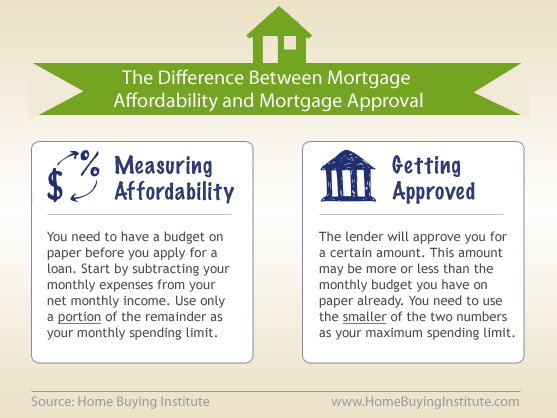

The image above reinforces this point. There’s a big difference getting approved for a home loan, and being able to comfortably afford it. That’s why there are two boxes in this image, instead of one. Keep this in mind as you shop for a mortgage.

Step 2 – Research Your Mortgage Options

“Oh man, I should’ve chosen an ARM loan to get a lower rate!” This is the kind of statement you might find yourself making if you fail to research your mortgage options. Or it might be the other way around: “I should have used a home loan with a fixed interest rate, instead of an adjustable rate.” … or … “I should have used an FHA loan to reduce the size of my down payment.” It happens all the time. Borrowers choose the option presented to them by a broker or lender, only to find out later that it may not have been the best option for their particular needs. This is why you need to research your financing options before you shop for a mortgage loan, or at least before applying.

You have two primary choices to make, for starters:

- Fixed vs. Adjustable — Do you want the long-term stability of a fixed-rate mortgage? Or do you want to use the riskier ARM loan to secure a lower interest rate for the first few years?

- Government vs. Conventional — Do you want to use a government-backed loan program, such as the FHA or VA programs, perhaps to minimize your down-payment cost? Or do you want to use a conventional mortgage without any kind of government backing to avoid paying extra insurance?

These are some of the first choices you’ll have to make when you shop for a mortgage. As you get further into the process, you’ll have other choices to make as well (such as whether or not you want to pay points at closing). We will discuss all of these things in detail.

Step 3 – Gather Your Financial Documents

As you get further into the application process, the lender will start asking you for a variety of financial documents. During the easy-credit days of the housing boom, you could get a loan with only a few documents. Not anymore. These days, you have to provide a veritable mountain of paperwork, for verification and underwriting purposes.

Here are some of the most commonly requested items:

- Documents to verify your income (pay stubs)

- Documents to verify your employment (employer letter)

- Bank account numbers, balances and similar details

- Tax documents for the last couple of years (W-2) *

- Documentation of other financial assets, such as investments

- Gift letters, if a family member is gifting you money for the down payment

* In the past, before the housing crash, you could give the lender a photocopy of your w-2 tax documents. These days, most of them want the tax documents to come directly from the IRS. So don’t be surprised if they ask you to sign an IRS Form 4506. This form gives the IRS permission to send a copy of your tax returns directly to the lender.

Believe it or not, this is only a partial list. The requests for documentation will come pouring in later on, as you get closer to the underwriting process. So you might not have to provide all of these documents as you shop for a mortgage. The lender might be able to give you a price quote with only a few documents, or just some basic information about your finances. But as the process moves forward, you can be sure they will request a mountain of paperwork. Lenders refer to these as “loan docs.” You’ll hear that phrase again when shopping for a mortgage.

Step 4 – Check Your Credit Scores

You should know your credit scores (plural) before you shop for a mortgage loan. This three-digit number can make the difference between approval and rejection, all by itself. In order to qualify for a home loan in 2012, you’ll probably need a score of at least 580. Some lenders set the bar even higher, at 600 for FHA loans and 620 for conventional mortgages. There are different credit-scoring models in use today. But most lenders are concerned with your FICO score, in particular.

Sadly, you have to purchase your score if you want to see it. The information is all about you, but it’s produced using a proprietary software program. So it generally doesn’t come free. You can get your scores for “free” if you sign up for some kind of credit-monitoring / identity-theft prevention service. Or you can purchase the scores by themselves through MyFICO.com or any of the credite bureau websites:

- www.myfico.com

- www.equifax.com

- www.experian.com

- www.transunion.com

We have a wealth of information about credit scores on this website. I recommend that you start with this article, if you want to learn more about this topic.

Step 5 – Get Rate Quotes from at Least Two Lenders

A rate quote (also referred to as a price quote) is not a commitment to lend. Far from it. This is just the lender’s way of giving you the information you need to take the next step, which is pre-approval. A price quote will generally include the approximate interest rate the lender is willing to offer, as well as their fees. It’s a ballpark figure at best. But it does give you something to work with as you shop for a mortgage loan.

How do you get a rate / price quote? Just contact the lender through their website, or call one of their loan officers. Tell them you’re not ready to make a commitment at this point, that you’re just shopping around for the lowest rates and fees.

This is a good place to discuss the difference between mortgage brokers and lenders. The lender is the financial institution that actually gives you the money to buy a house — a bank or credit union, in most cases. A mortgage broker, on the other hand, is a “matchmaker” who connects borrowers with lenders.

You don’t have to use a broker when you shop for a mortgage loan. It’s optional. The benefit is that the broker may work with several different lenders, so he might be able to find you the right loan program in less time (and with less drama). The downside is that brokers charge a fee for their services, and this fee may get passed along to you. Don’t be afraid to contact lenders directly. Remember, if you’re a well-qualified borrower, they’ll want your business!

When you get quotes from lenders, you want to know the following:

- Rates — Ask for a list of current mortgage rates each lender is currently charging, along with their lowest rate for that day or week. Just keep in mind your rate will vary, based on your individual qualifications.

- Points — A point is a type of prepaid interest. One point equals one percent of the loan amount. Ask the lender what kind of points you might have to pay, in order to lock in the rates mentioned above. You might be able to find information about rates and points in the real estate section of your local newspaper.

- Fees — You will encounter many different fees when you shop for a mortgage loan. Collectively, these are often referred to as closing costs. But not all of them are paid at closing. Some fees, like the application and property appraisal fees, may be charged up front. Each lender you speak to should be able to provide an estimate of its fees in advance. Later, when you submit a formal application, you’ll receive more information about fees through the Good Faith Estimate.

- Down payment — You also need to find out about each lender’s down-payment requirements. For a conventional (regular) mortgage loan, you’ll have to put down at least 5%. Some lenders may require a down payment of 10% or more. With a government-insured FHA loan, your down payment could be as little as 3.5% of the purchase price. VA loans offer 100% financing with no down payment at all.

Here’s what the Federal Reserve says about gathering this info:

Knowing just the amount of the monthly payment or the interest rate is not enough. Ask for information about the same loan amount, loan term, and type of loan so that you can compare the information. Source: http://www.federalreserve.gov/pubs/mortgage/mortb_1.htm

Try to obtain as much of this information as possible when you shop for a mortgage. It may seem like a lot of work, and sometimes it is. But you need to go into this process with a research-minded approach. The good news is that the Internet has made it a lot easier to gather rate quotes and other information from lenders. There are various lending networks online today, where you can get information from several companies at once. LendingTree and the Zillow Mortgage Marketplace are two good examples.

Step 6 -Get Pre-Approved by Your Chosen Lender

Getting pre-approved for a mortgage loan is different from getting price / rate quotes from a lender. You can get a basic rate quote without providing much in the way of financial details or documentation. Pre-approval goes a step further. This is when the lender reviews your financial situation in more detail, and then tells you how much they might be willing to lend you. I’ve written extensively on this subject in the past. You can read this article to learn more about it.

Here’s what you need to know about pre-approval, in a nutshell. It’s a key step in the mortgage-shopping process, because it gives you a pretty good idea how much the lender will give you. This is obviously an important piece of information when it comes time to shop for a house. Refer back to step #1 above, the budgeting process. If the pre-approval amount is much higher than the financial comfort zone you’ve established for yourself, you should lean toward the smaller number as your spending limit. In other words, don’t take on too much of a home loan, just because the lender is willing to give you one.

Also, you should realize that it’s still possible to be denied for a loan, even after you’ve been pre-approved by the lender. It’s an increasingly common scenario these days, given the current state of the mortgage market. The best thing you can do is to have a “backup” lender identified, in case something happens with the first one. And don’t think of your pre-approval as a guarantee. It’s not.

Editorial note: This is a lesson on how to shop for a mortgage loan. The rest of these steps pertain to the final approval and closing process. But we need to discuss them briefly, just for the sake of continuity. You need to understand how the early steps in the process (such as pre-approval) tie into the later steps, such as underwriting and final approval.

Step 7 – Find a House and Make an Offer

Once you’ve been pre-approved by a lender, you can shop for a home more effectively. At this point you will have a better idea what your price range is, based on the budgeting you did earlier (step #1) and the lender’s pre-approval (step #6). So you find a house that meets your needs, and you submit a written offer to buy it. Once the seller accepts your offer, you would then take the purchase agreement back to your lender along with a formal loan application.

Step 8 – Submit Your Loan Application

This step is different from what you did during the pre-approval stage. When getting pre-approved, you probably didn’t have to submit an actual loan application. Typically, lenders don’t require a formal application until you have a purchase agreement in hand (in other words, when you’re actually ready to buy a house).

This process is fairly straightforward, because most lenders use the same application form. It’s called the Uniform Residential Loan Application. This document is also referred to as “the 1003,” in reference to the Fannie Mae form number assigned to it. You can download a copy on this page of the Fannie Mae website, and I recommend that you do. This will give you some additional insight into what lenders will ask you for, during the application process. This form can be used for FHA, VA, USDA and conventional mortgage loans.

When you submit an application, the lender is required to provide you with another important document. It’s called the Good Faith Estimate, and it is described below.

Step 9 – Review the Good Faith Estimate

When you shop for a mortgage loan, you will eventually have to submit a formal application. Shortly after this, the lender should provide you with a standardized document known as the Good Faith Estimate (GFE). This document gives you an approximation of the closing costs associated with your loan.

Here’s what the Real Estate Settlement Procedures Act (RESPA) says about it:

Each lender shall include with the booklet a good faith estimate of the amount or range of charges for specific settlement services the borrower is likely to incur in connection with the settlement … [and] shall provide the booklet described in such subsection to each person from whom it receives or for whom it prepares a written application to borrow money to finance the purchase of residential real estate. Such booklet shall be provided by delivering it or placing it in the mail not later than 3 business days after the lender receives the application. Source: 12 U.S.C. § 2604 : US Code – Section 2604: Special information booklets

So, within three days of receiving your mortgage application, the lender should be sending you two things: (1) an information booklet about settlement / closing costs, and (2) a written estimate of your closing costs using the standardized Good Faith Estimate form. This information is required by federal law, and is designed to help you shop for a mortgage loan.

The key word here is “estimate.” You can, and should, expect your actual closing costs to be slightly more than the amount mentioned in the GFE form. With that being said, the GFEs are more accurate today than they were in the past. That’s because of some new rules that took effect in 2010. Many of the charges listed on the Good Faith Estimate have a 10% rule assigned to them. This means the charges cannot increase by more than 10%, from the initial estimate to the actual closing day. There’s actually a section on the GFE form labeled as “Charges That in Total Cannot Increase More than 10%.”

But even with these new rules, it is rare for the actual closing costs to be the exact same as the estimated close. So be prepared for this kind of discrepancy as you shop for a mortgage loan. Put extra money aside, in case you need it.

Step 10 – Agree on the Terms and Lock in Your Rate

Mortgage rates change on a daily basis. So the rate quote you initially receive from the lender may not be relevant when you actually apply for the loan. Eventually, you will want to “lock” the interest rate to prevent further fluctuations. This can be done when you are ready to move forward with the loan process. It prevents your mortgage rate from changing between the time of application and your actual closing day.

You can also let the rate “float” until a few days before closing. But this is a gamble that can go both ways. If rates drop, you will benefit from rolling the dice on the float strategy. But if rates go up, you’ll end up paying more for the loan when you could have locked in a lower rate. Most first-time buyers lock early, simply because they are unfamiliar with the process. It’s a safe strategy. Learn more about this topic.

How to Shop for a Mortgage Within Your Budget

If you only absorb one lesson from this article, make it this one. You need to have a housing budget in mind before you shop for a mortgage loan. This is actually one of the most common mistakes among first-time home buyers. Many buyers assume that their lenders will look out for them, steering them away from over-sized loans. In a perfect world, that’s how it would work. But the lending system in the United States is far from perfect.

The secondary mortgage market (Freddie Mac, Wall Street, etc.) basically absolves lenders of any long-term responsibility. The lender can sell the loan off their books shortly after you close on the house. So, frankly, they don’t care what happens to you down the road. As long as the loan conforms to the standards set by Fannie Mae and Freddie Mac, the lender is happy.

What does all of this mean to you, as you shop for a mortgage loan? It means that you are the only person concerned with your long-term financial stability. So you need to look out for yourself. Always start with step #1 when shopping for a home loan. Figure out how much you can comfortably afford to spend on your housing costs, given your current income and debt situation. Stay within that limit, regardless of what the lender tells you.

Brandon Cornett

Brandon Cornett is a veteran real estate market analyst, reporter, and creator of the Home Buying Institute. He has been covering the U.S. real estate market for more than 15 years. About the author