How Does an Earnest Money Deposit Work?

First-time home buyers typically have a lot of questions about the earnest money deposit.

This concern is warranted. An earnest money deposit can add up to thousands of dollars in a typical real estate market, or more than $10,000 in a pricey area like coastal California.

So it's important to understand: (A) what this deposit is, (B) how the process works, and (C) how to protect the money from forfeiture during a real estate deal.

Here are six things home buyers need to know right off the bat:

- Earnest money is a good-faith deposit that home buyers make to show they are serious about purchasing a particular property.

- While the amount can vary, it usually equals 1% to 3% of the purchase price (or the amount the buyer is offering to pay).

- The home buyer provides these funds when they submit their purchase offer to the seller, along with the other proposed terms.

- The money usually gets held by a neutral third party, like an escrow or title company, until the real estate deal is finalized.

- Buyers can get their earnest money back if the seller rejects their offer or if a contract contingency allows them to back out.

- Sellers can keep the deposit if the buyer backs out without a valid contingency or reason. So there's some risk involved.

Those are the key takeaways on this subject. Now let's take a deeper dive.

What Is an Earnest Money Deposit?

When you make an offer to buy a house, you want the seller to take your offer seriously. So you offer a "good faith" deposit toward the purchase price.

This is also referred to as the earnest money deposit. You are using this money to show the seller you are earnest (an old-fashioned word for serious) about buying their house.

But don't confuse this with the down payment on the house. They are two separate things, though both can be applied toward the purchase price later on.

- If the seller accepts your offer and the deal goes through, the earnest money will go toward the purchase of the house. So it becomes part of your investment in the property.

- If you back out of the deal, however, you could wind up forfeiting the earnest money to the seller. We'll talk more about these scenarios below.

These deposits are more of a real estate tradition than anything else. There's no law requiring you to pay earnest money when making an offer on a house.

But it does send a signal about you as a buyer. It says you're not trying to waste anyone's time, and that you are seriously interested in the property.

When Does the Home Buyer Actually Pay It?

In most cases, you would pay the earnest money when making an offer to buy a house. In fact, the exact amount should be spelled out in the contract.

When we refer to the "contract" in this context, we're talking about the purchase agreement that you write up. Your real estate agent should help you prepare this document.

The purchase agreement will include the amount you are offering to pay for the house, as well as the amount of earnest money you are paying.

The purchase agreement might also include certain contingencies that allow you to back out of the deal and protect your deposit. We will talk more about contingencies below.

How Much Should I Pay?

Earnest money deposits usually range between 1% and 3% of the purchase price. But it can vary from one real estate market to the next, due to the level of competition.

A larger-than-average deposit could help your offer stand out in a competitive housing market. A smaller or no deposit, on the other hand, results in a weaker offer and might cost you the home.

There are no laws governing this, by the way. It's more a matter of local custom and tradition. Your real estate agent is your best resource in this area, since they know what's typical in your area.

In most cases, the best practice is to follow local customs when making your earnest money payment. But again, this can vary based on current real estate trends and how "hot" the market is.

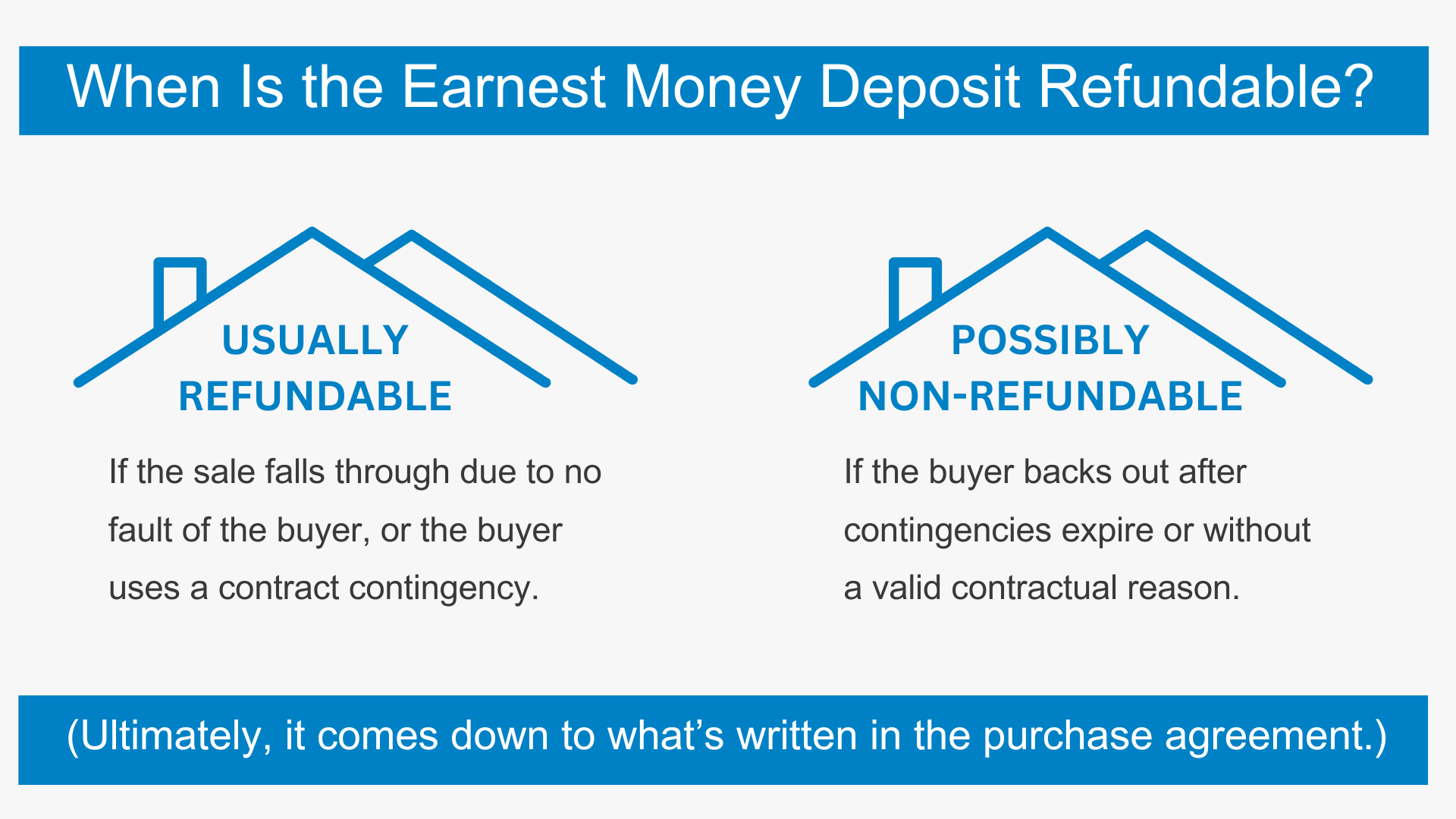

When Is the Earnest Money Refundable?

There are two scenarios where you could get your earnest money back.

The first scenario is if the seller rejects your offer. If you make an offer to buy a house and the seller turns it down, they are required to give you the earnest money back. This should be clearly stated in the purchase agreement.

It only makes sense, when you think about it. You are offering this money as a good-faith deposit toward the purchase of the home. But if the seller rejects your offer outright, they have no business keeping your earnest money.

The second scenario where the buyer can get the earnest money back has to do with contingencies.

When you make an offer to buy a house, you can also make the offer contingent (or dependent) on certain things (such as mortgage financing).

The home inspection is a good example. Home buyers can add a contingency to the purchase agreement that says they can back out of the deal based on the inspection results.

When Can the Seller Keep the Deposit?

If you back out of the contract for no good reason, you might forfeit or lose your earnest money.

This is why contingencies are so important in a real estate purchase agreement. They identify specific scenarios or reasons why the buyer can exit the transaction.

If you simply have a "change of heart" regarding the purchase, the seller will probably be able to keep the earnest money payment.

Again, all of this should be clearly expressed within the purchase contract. Review this document with your real estate agent, and make sure you understand how the contingencies work before submitting an offer.

Who Holds the Money After the Offer Is Made?

Normally, the buyer gives the earnest money payment to an escrow or title company. The escrow agent will act as a middleman between the buyer and seller.

This neutral third party is responsible for closing the deal and ensuring all funds are distributed properly. In rare cases, the earnest money is paid directly to the seller (not recommended).

Some Closing Thoughts

In closing, I would like to stress that the earnest money part of this process is mostly standardized. You shouldn't spend a lot of time analyzing this. Just ask your agent what a standard deposit amount is for your area, and pay that amount when you make your offer.

If you pay a lot less than the average good-faith payment, you risk having your offer rejected. If you pay a lot more than the standard amount, you risk losing more money if you back out of the contract.

In a typical home-buying scenario, it's often best to make a "standard" earnest money deposit while including the appropriate contingencies to protect it.