In this guide: 10 ways mortgage brokers can get more clients in 2024, with a mix of digital strategies like social media and good old-fashioned networking and referrals.

As a mortgage broker, you have a wide range of marketing strategies and techniques you can use to attract new clients and grow your business. And new channels are popping up all the time.

But this is also where a lot of new mortgage brokers get stuck. With such a dizzying array of marketing options to choose from, it’s hard to know which ones to pursue when you’re first starting out.

We created this guide to help you understand the different ways you can get clients as a mortgage broker, and to help you choose the right strategies for your business.

10 Ways Mortgage Brokers Can Get Clients

You might find it best to start with two to four marketing methods that align with your budget, talents and inclinations. Review the list below and write down the strategies that resonate with you, for further exploration. Start there and bring additional channels into the mix as needed.

Here are 10 ways for mortgage brokers to get more clients in 2024:

1. Blogging and Content Marketing

Blogging and other content-related strategies can help you steadily increase your website traffic over time. These strategies help you attract the kinds of people who need your services. And there’s no limit to how far you can go with it. Blogging is a proven way to get more clients as a mortgage broker.

Pro tips: Create your own original content, rather than using “stock” content from some other source. Publish lengthy, in-depth and useful articles designed to help your target audience. Publish new blog posts on a regular basis, weekly if possible. Incorporate relevant keywords to improve search engine visibility.

Check out our blogging guide to learn more

2. Customer Service

It’s been said before but bears repeating. Providing a great customer experience can help you get repeat business from past clients, along with referrals and recommendations for new clients.

When it comes to the mortgage broker business model, “customer service” can include many different things. For starters, you want to educate your clients on their financing options and help them choose the best one. You also want to keep them in the loop throughout the process, with a steady stream of communication.

This, combined with an on-time closing, will result in happy mortgage clients, repeat business and referrals. Customer care is a no-cost way to get more clients as a mortgage broker.

3. Community Involvement

Community involvement is one of the most rewarding strategies for getting new mortgage clients. And it comes in many forms.

You can sponsor local sports teams, events, and charitable causes. You could speak at community events related to homeownership or financial literacy. Use your imagination and have fun with it.

4. Email Marketing

Email marketing and newsletters give you a way to stay in touch with previous mortgage clients, as well as potential clients you’ve never even worked with. You could create a newsletter dedicated to your local real estate market or some other topic of interest, and at very little cost.

This is a long-term strategy that takes time to develop. As you grow your list over time, you’ll get more value from it in the form of leads and referrals. You could even combine this with some of the other strategies on this list, such as blogging and social media. (More to follow on that.)

Pro tips: Provide your own original insights, updates and reporting. Avoid the temptation to use “canned” content that doesn’t serve your audience. Put your subscription link on your website, in your email signature, and anywhere else you can think of. Consider naming and branding your newsletter the way a magazine or newspaper would.

5. Follow-Up and Nurturing

It can take a lot of time and effort for mortgage brokers to get new clients and to generate leads. So the last thing you want is to have one of those contacts “fall through the cracks” due to poor follow-up.

Create a system for following up on your leads. Use a customer relationship management (CRM) software program to manage your mortgage leads, track interactions, and streamline the communication process.

6. Lead Generation Companies

Lead generation platforms (or “lead aggregators”) are another way for mortgage brokers to get new clients. These platforms connect you with pre-qualified leads who are actively searching for mortgage loans.

Popular examples include NerdWallet, Realtor.com, LendingTree and Zillow.

These platforms collect information from potential borrowers and then distribute the leads to mortgage brokers or lenders who pay to receive them. They act as online intermediaries, connecting potential borrowers with mortgage brokers looking for new clients.

But be warned, some of these services also have a reputation for delivering stale or low-quality leads. If you use them, start off with a trial period so you can measure the quality and value of what you’re receiving.

Pro tips: Lead generation services offer another way for mortgage brokers to get clients. But you have to be careful that you don’t become overly dependent on them. Try to create a more “layered” approach to lead generation, by combining organic marketing strategies (like blogging and social media) with paid methods (such as PPC and lead aggregators).

7. Networking

Networking might not be as sleek or “sexy” as some of the other mortgage marketing strategies on this list. But it’s still one of the best ways for mortgage brokers to get new clients and grow their businesses. Best of all, you can do it for free with no technical knowledge needed.

When it comes to networking for business growth, mortgage brokers have many different avenues to explore. First of all, there’s professional networking. This is where you interact with (and perhaps partner with) real estate agents or financial advisors in your area. And there’s some mutual benefit to be gained there.

You can also leverage your existing network. Reach out to family, friends, and former colleagues to let them know about your mortgage services. Don’t be shy about asking for referrals, especially when requesting them from someone who knows and trust you. Just put it out there!

Mortgage brokers have been getting clients through networking for decades. But these days, it’s a lot easier thanks to social media and other web-based communications platforms. Social media sites like Facebook and LinkedIn can help you take your networking strategy to the next level to gain new clients and grow your mortgage broker business.

8. Niche Focus

Depending on your business model and marketing goals, you might be able to get new clients by focusing on a particular niche.

For example, some mortgage brokers target military members and veterans seeking VA loans … or first-time home buyers … or investors who need “hard money” financing options, etc.

By specializing in a particular niche, you can tailor your mortgage marketing message to reach that particular audience. You can also position yourself as an authority within that niche, which in turn could increase your conversion rate and help you gain new clients.

(Example: “Jane Smith is an Arizona VA loan specialist with 12 years’ experience helping military members and veterans achieve the dream of homeownership.”)

9. Paid Advertising

Paid advertising is one of the fastest ways for a mortgage broker to get clients. These channels allow you to put your message in front of mortgage shoppers by the very next business day. Examples of paid advertising include Facebook ads and Google AdWords pay-per-click advertising.

This strategy also allows you to present a targeted message to a specific audience, making it well suited for the niche focus mentioned above. You can tailor your ads to specific demographics and financing needs in order to generate qualified leads, rather than “mass marketing” to a mixed group.

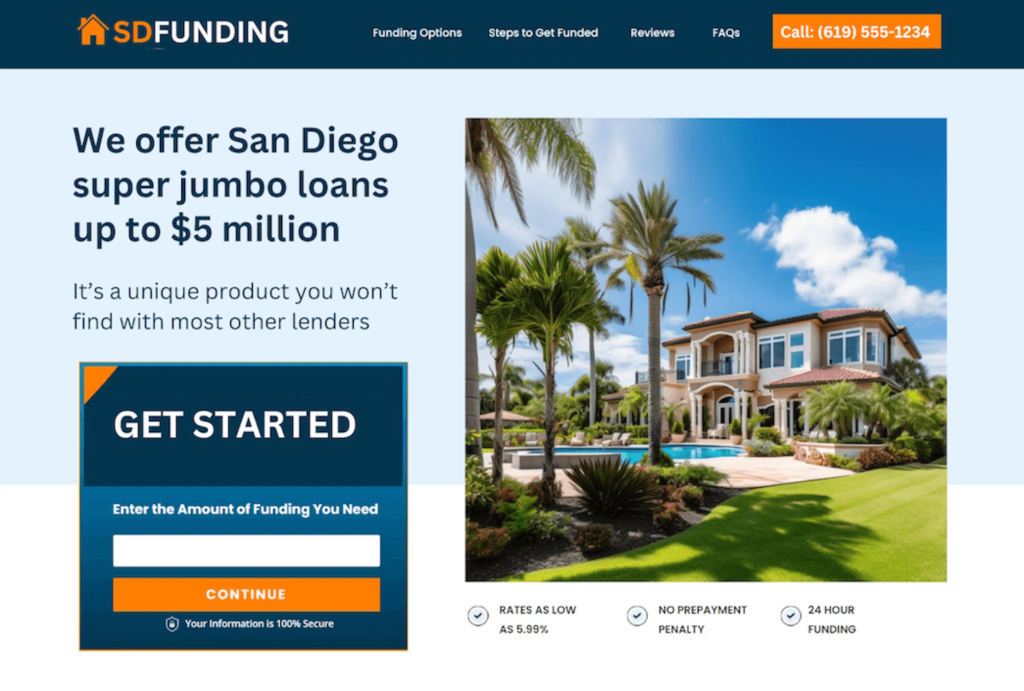

Pro tips: If you’re going to use paid advertising to drive visitors to your mortgage website, be sure to send them to a product-specific landing page (rather than the home page). As mentioned, PPC works best when you present a specific product, offer or message to a specific audience. So the landing page should be specific as well, as in the example shown below.

10. Social Media Marketing

Social media can help mortgage brokers get clients, and in a variety of ways.

First off, you can share mortgage and real estate information with your personal social network, possibly earning referrals and recommendations. You can also promote all of that high-quality blog content we talked about earlier, to steer people back to your site.

In addition to these no-cost mortgage social media strategies, you could also use their paid advertising features. Facebook ads, in particular, are popular among mortgage brokers because of the flexibility they offer in terms of targeting and ad design.

Pro tip: You’ll get more mortgage clients through social media if you steadily grow your following over time. And the best way to do that is by turning your social account into a useful information service for your target audience. You’ll find more on that strategy here.

Combine Short & Long-Term Marketing Strategies

You might have noticed that this list includes a mix of both short- and long-term mortgage broker marketing strategies for getting new clients. That’s by design. And depending on your situation, you might need to use more of than the other.

For instance, new mortgage brokers just starting out are typically in a hurry to gain new clients. So they might explore strategies that can generate leads more quickly, such as pay-per-click advertising, lead generation services, and possibly social media.

On the other hand, if you’ve been in business for a while and have a good pipeline going, you might be interested in some of the long-term strategies that deliver sustainable growth. You might want to invest in things like blogging, SEO, and email newsletters.

In most cases, a mix of strategies will deliver the best results. So don’t put all of your marketing eggs into one basket. Choose the client-acquisition strategies that make the most sense based on where you are right now, and then layer on over time.

Track Results to See What’s Bringing Clients

One day, out of the blue, somebody emails you with a mortgage-related question. Being the diligent professional that you are, you answer their questions and ask if you can call to provide more information. Eventually, this person turns into a new client and closes a loan.

- But where did this person come from?

- Which one of your marketing strategies brought them to your site?

If you’re unable to answer these kinds of questions, you’ve got work to do!

This article explains how to get clients as a mortgage broker, offering a wide range of marketing and messaging strategies. But it’s equally important to track your results over time, so you can figure out which strategies are bringing you the most clients—and which ones are lagging.

This kind of knowledge helps you in two ways. It allows you to invest more resources into your most productive marketing channels. It also reveals the less successful marketing channels, so you can decide whether to modify, deemphasize, or abandon them.

Tracking doesn’t have to be complicated or expensive. One of the easiest and low-tech methods is simply to ask new mortgage clients: “How did you hear about me?” You could then edit the contact in your CRM program, to include the marketing channel that brought them to you.

If you want to take your tracking to the next level, consider one or more of the following:

- Call Tracking: You can assign unique phone numbers to different marketing campaigns. By tracking which numbers receive the most calls, you’ll know which campaigns are generating more interest.

- URL Parameters: You can incorporate specific parameters in the URLs used for different campaigns or landing pages. Tools like Google Analytics can track these parameters, revealing which campaigns are driving more traffic to the website.

- Conversion Tracking: You can set up conversion tracking in tools like Google Analytics or CRM systems. This will show you which marketing channels or campaigns are leading to actual conversions, such as loan applications or client sign-ups.

- Email Marketing Metrics: You can analyze email marketing data like open rates, click-through rates, and conversions to understand the effectiveness of email campaigns in generating leads.

- Social Media Insights: Platforms like Facebook, LinkedIn, and Twitter offer analytics tools that reveal how many people engaged with posts, clicked links, or filled out contact forms after seeing social media content.

Let us help you! As you can see, you have a lot of different ways to get clients as a mortgage broker. And we can help. Our content marketing package includes many of the “organic” marketing strategies featured in this article, including blogging, PR and SEO.

Brandon Cornett

Brandon Cornett is a mortgage content marketing expert with 17 years of experience. He also created the Home Buying Institute, one of the nation's leading informational websites for home buyers.